Henry Schein Financial Services offers patient payments and business solutions that can help your practice grow and improve your bottom line. We are dedicated to providing health care practitioners like you with services that increase your revenue and reduce the cost of doing business so that you can focus on providing quality care to your patients. From dentist credit cards and credit card processing to patient financing and dental practice location analysis reports Henry Schein Financial Services can help you reduce your operating expenses and save money.

Improve operational efficiency, reduce expenses, and grow your bottom line

Credit Card & Payment Processing

Review your dental Credit Card and Payment Processing to help your practice reduce unnecessary expenses and improve operating efficiency.

Patient Financing with CareCredit

Provide your patients with more options to pay for the treatment they want and need, with our Patient Financing solutions.

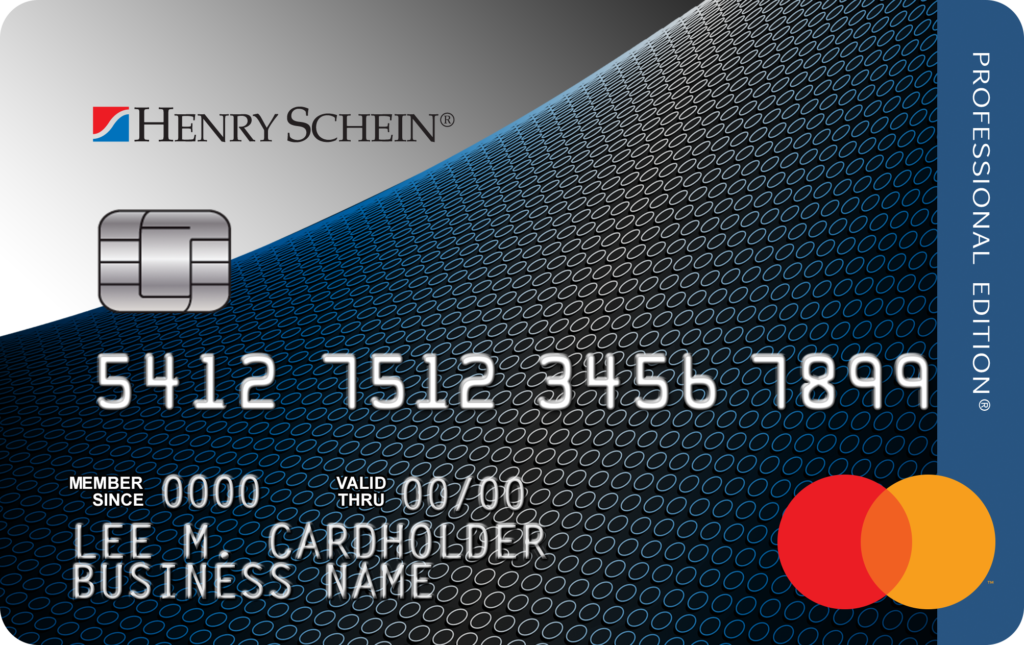

Henry Schein Dental Credit Card

The Henry Schein Credit Card is a credit card made for dentists with great rewards for your everyday practice, business, and travel purchases.

Dental Demographics Location Analysis Reports

From new practice start-ups to current practice expansion – ensure you have the best practice location to suit your goals.

Enhance your dental practice, increase revenue & improve your practice finances

Services to help you run your practice

©2024 Henry Schein, Inc. Neither Henry Schein, Inc. nor Henry Schein Financial Services provides financial advice. Please consult your financial advisor. Neither Henry Schein, Inc. nor Henry Schein Financial Services is a bank and neither represents itself as such, nor conducts banking activities. Henry Schein Financial Services may receive a marketing fee from the vendor for products/services purchased.